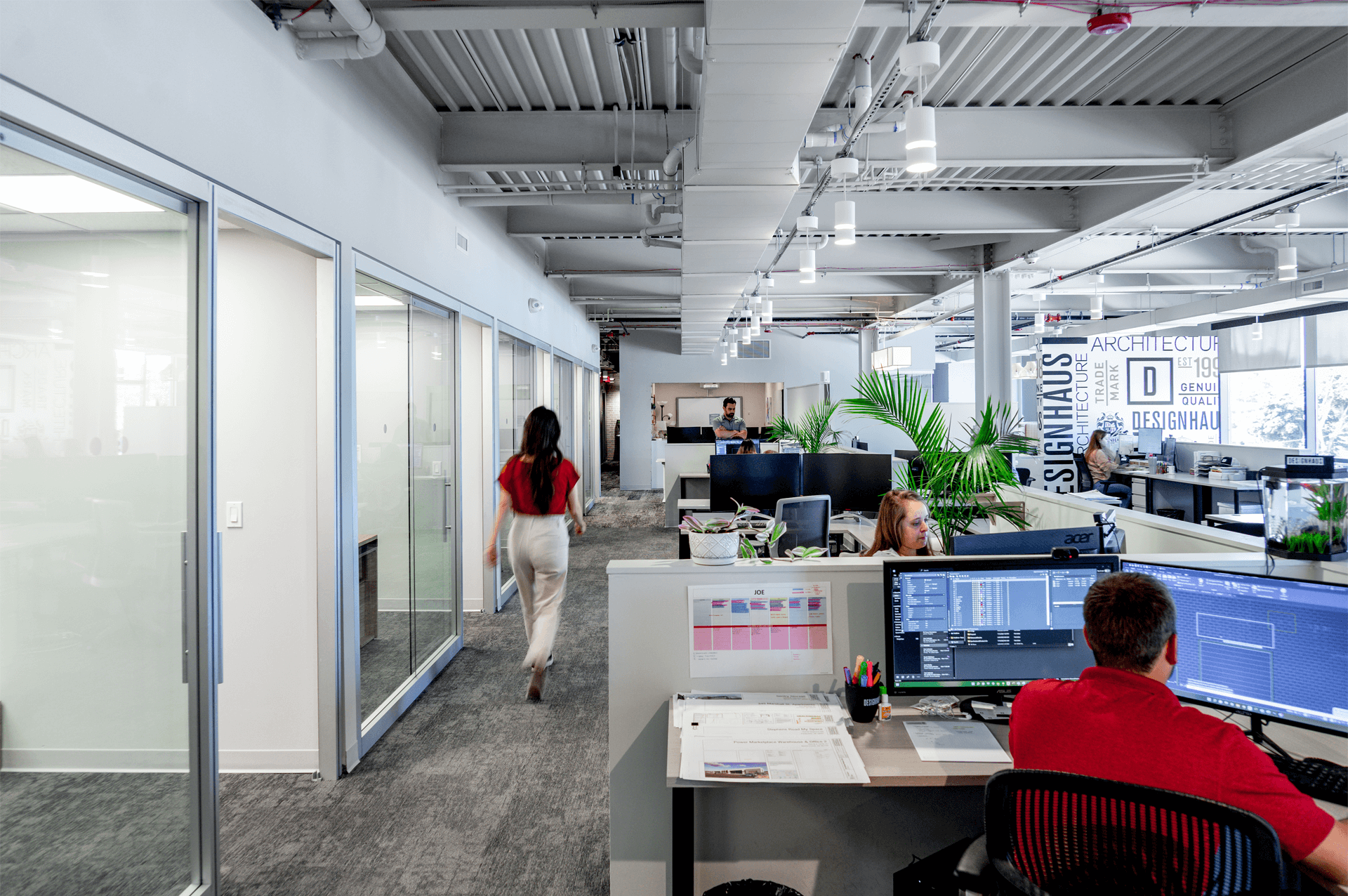

“Diversification” describes my experience at the helm of Designhaus during the last couple of years. Our private development prospects seem to be flowing in steadily and maintaining a pattern of diversity regarding use-type, market-type and location. While Designhaus is experiencing higher-than-usual growth, there seem to be real and sustainable roots as to why. Fears of a “bubble” are there, but beneath the surface data, I take note that the perspective and current commissions are spanning an extraordinarily broad spectrum.

“THE DISTRICT” IS A NEW MIXED USE COMPLEX TO BE BUILT REPLACING OUTDATED RETAIL PRODUCT

A CASUALTY OF THE RECENT RECESSION

I am old enough to remember and have been affected by, the Middle East development bubble of the 1990’s, the Big House bubble of the 2000’s, the “suburban beltway” office bubble, and the self-storage bubble. The carnage that followed each of these bubbles destroyed anyone that was not diversified; architects, contractors, and developers alike. These bubbles left surpluses that would take years to absorb. Certainly, lending practices changed after 2008 to lessen the likelihood of market bubbles. Developers also changed tactics. From 2008 to 2013, due to bubble surpluses, private development was basically stalled as buildings and leases were financially restructured to create some stability. To make matters worse, during those five years even the poor economy had ongoing underlying demand that was not being supplied because development was frozen by the financing world.

The stalled development market of 2008-2013 make these days feel like we might be in a bubble based on the demanding and growing work-load. But as I analyze my firm and see an even spread of work in markets (Detroit, Cleveland, Midland, Dallas, Orlando, Charleston, Cincinnati and Atlanta) specialty retail, self storage, adaptive reuse, multi-family, urban in-fill, manufacturing and medical office seem to be clipping along in an almost uniform and steady pace. Secondary uses follow the larger development efforts, such as restaurants, chiropractic offices, and small shops. This “never before seen” diversity helps quell my fears of a bubble.

HIGH END SELF STORAGE FACILITY COMPLIMENTED BY A FREE STANDING RETAIL BUILDING IN SOUTH CAROLINA

THE ORIGINAL SEA-RAY BOAT PLANT HAS BEEN ADAPTIVELY RE-PURPOSED INTO A FAMILY ACTIVITY CENTER

PHOTO CREDIT: MCMANSION HELL

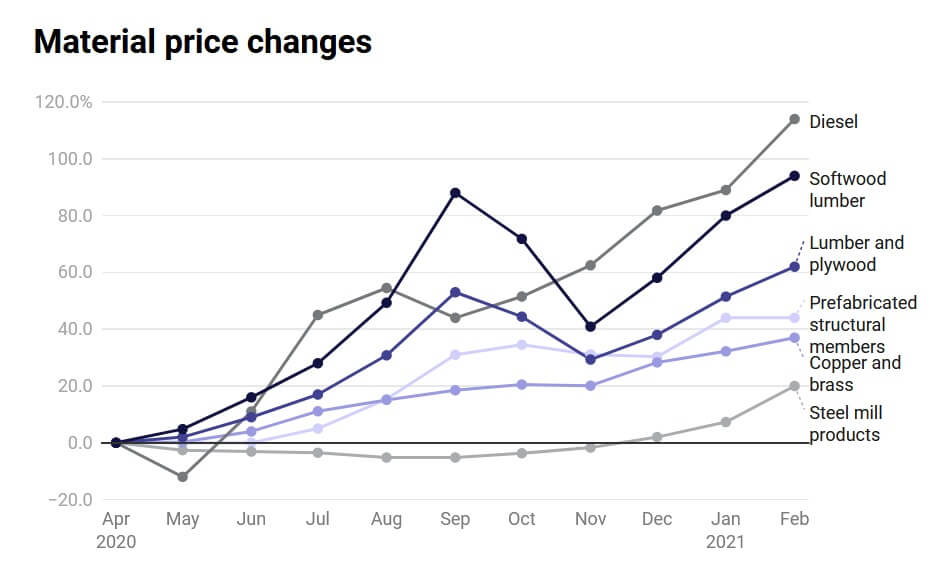

Interest rates aside, and in lieu of this diversity, there may be certain markets and use-types soon hurt by other economic and social factors. In highly taxed areas like Chicago, I have seen development begin to pull back. Sectors such as Senior Living, which in my opinion has been hot for too long is likely approaching saturation and risks bubble status. Another sector in the “hurt locker” is Big-Box brick-and-mortar retail, including most Class B Shopping Malls due primarily to online shopping habits. Finally, changes in the lifestyle choices of young people will no doubt affect the “McMansion” development sector, which will be exacerbated by the Senior population shift into Senior Living and into dual-location smaller homes and condos. Needless to say, Designhaus will be staying away from these looming bubbles, and instead will position the firm for the adaptation of the assets that do fall.